pay indiana business taxes online

Pay Your Property Taxes. Prepare to file and pay your Indiana business taxes.

Missouri Sales Tax Small Business Guide Truic

Your browser appears to have cookies disabled.

. Indiana Small Business Development Center. SBAgovs Business Licenses and Permits Search Tool. 877690-3729 Jurisdiction Code 2490.

The self-employment tax is a social security and Medicare tax for individuals who work for themselves. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more. Any employees will also need to pay state income tax.

INTIME provides access to manage and pay. Johnson County Treasurer 86 W. Find Indiana tax forms.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Indiana businesses have to pay taxes at the state and federal levels. Home Taxes and Fees.

After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business. States with the highest capital stock tax rates include Arkansas 030 percent Louisiana 0275 percent. Cookies are required to use this site.

Your business may be required to file information returns to report. The Indiana income tax rate is set to 323 percent. Know when I will receive my tax refund.

However some counties within Indiana have an additional tax rate making the. Connecticut plans to phase out its tax by January 1 2024. Mail to office.

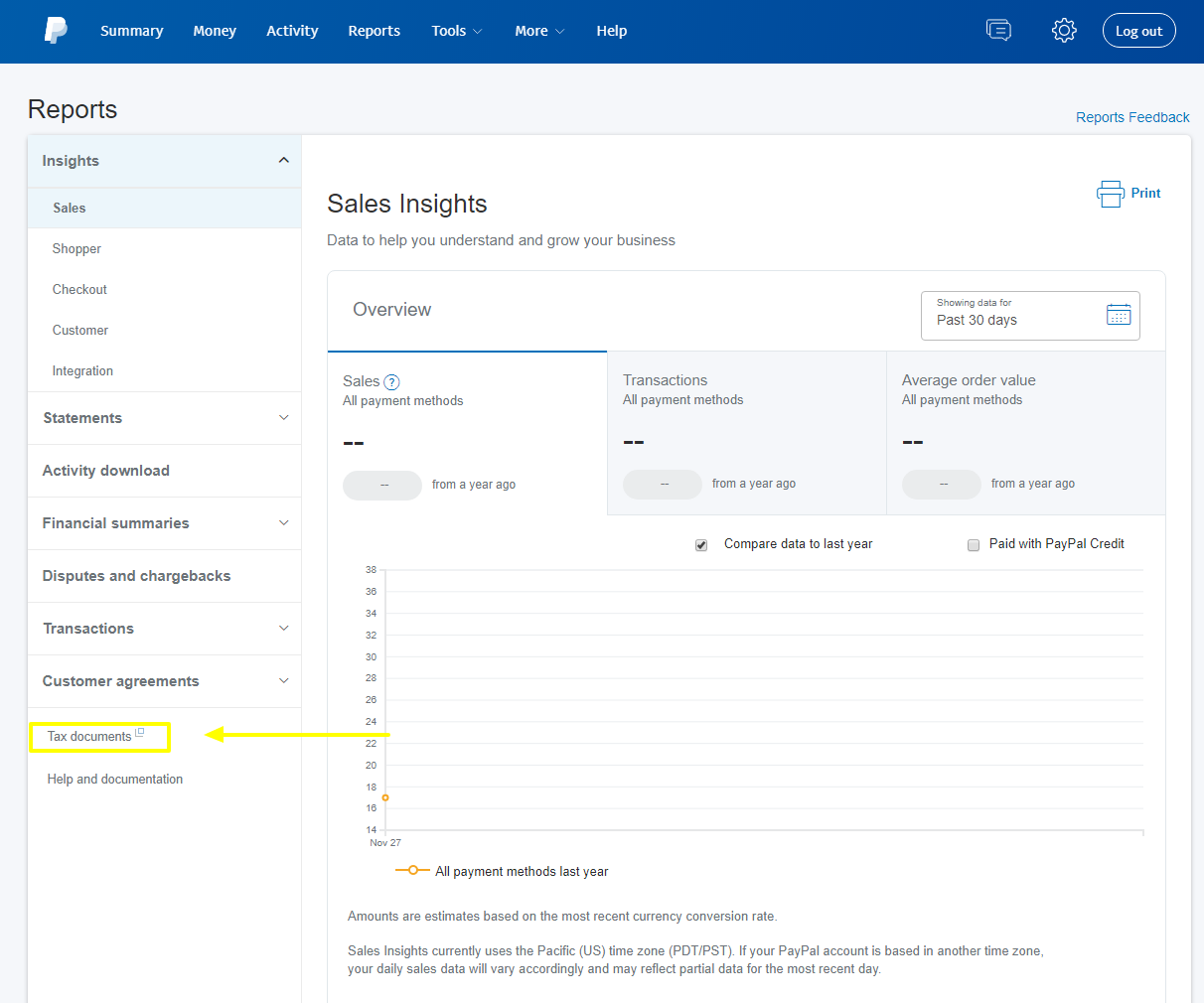

Department of Administration - Procurement Division. The tax rate is set by the government and is usually a percentage of the property value. The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal.

Prepare to file and pay your Indiana business taxes You can file and pay with the. To calculate your property tax bill you will need to multiply the taxable value of your. If you have an account or would like to create one or if you.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. You can file and pay with the Indiana DOR online using the Indiana Taxpayer Information Management Engine INTIME. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales.

Court Street Franklin IN 46131 include tax coupon with payment PAY BY PHONE.

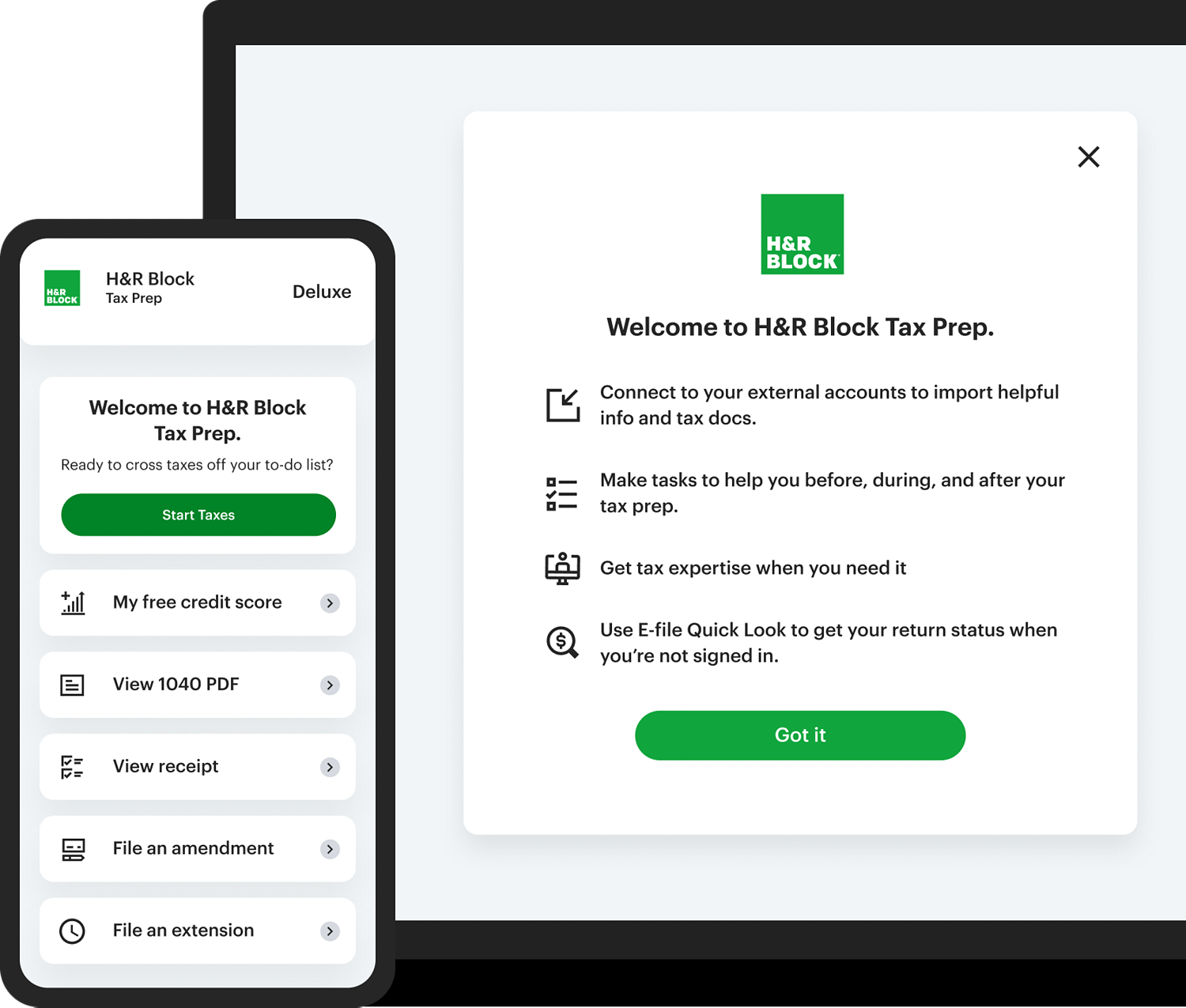

State Tax Filing Software H R Block

Dor Unemployment Compensation State Taxes

Indiana Tax Refund Here S When You Can Expect To Receive Yours

How Do State And Local Sales Taxes Work Tax Policy Center

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How To Pay Sales Tax For Small Business 6 Step Guide Chart

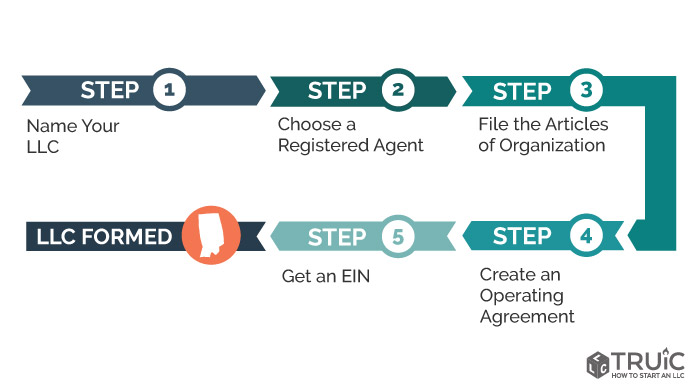

Llc Indiana How To Start An Llc In Indiana Truic

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Guide And Calculator 2022 Indiana Sales Tax Taxjar

Deluxe Online Tax Filing E File Tax Prep H R Block

Indiana S Tax Structure Hard On Poor Families

Business Income Taxes In Indiana Who Pays

Indiana S Corporation How To Set Up An S Corp In Indiana Zenbusiness Inc

Indiana U S Small Business Administration

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding